Primary Times - the definitive what’s on and where to go family guide of activities and events for children of primary school age. Things to do with your kids during the school holidays including arts and craft activities, music and theatre for children, parties, competitions, days out, and family attractions along with term time drama schools, dance classes, after school clubs and sports activities. Things to do at a place near you!

Parents urged to give children greater financial responsibility at an earlier age

New Prepaid Debit Card with Mobile Banking App offers empowering, safe service for parents and children

Osper launches in the UK today offering parents the help they need to equip their children with the money management skills needed for adult life. The mobile-only, branchless, simple and secure banking service and Prepaid Debit Card for 8-18 year olds gives young people financial freedom and encourages them to take responsibility for their money. Osper directly addresses the needs of 21st Century families such as that of TV personality Davina McCall, making talking about and dealing with money simpler and more straight-forward than ever before.

Osper launches in the UK today offering parents the help they need to equip their children with the money management skills needed for adult life. The mobile-only, branchless, simple and secure banking service and Prepaid Debit Card for 8-18 year olds gives young people financial freedom and encourages them to take responsibility for their money. Osper directly addresses the needs of 21st Century families such as that of TV personality Davina McCall, making talking about and dealing with money simpler and more straight-forward than ever before.

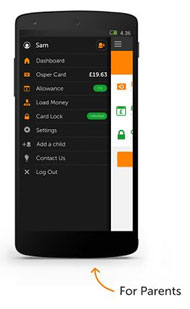

The service is composed of a MasterCard® Prepaid Debit Card accompanied by a simple mobile app, which comes with separate logins for both young people and their parents. Osper is designed to give parents the confidence to transfer more responsibility to their children with regard to making money decisions. Rather than parents handing over cash or lending their own Credit Card for online purchases, young people can use their Osper Card in stores, for cash withdrawals at ATMs and for online purchases and service subscriptions such as Amazon and iTunes. All transactions are tracked within the app and as Osper Cards are prepaid - young people can only spend the money they have available to them. Osper is not a credit card.

The service is already being used by a number of ‘founding families’, among whom is TV personality and devoted mother of 3, Davina McCall (pictured above).

Davina said: “When I heard about Osper and its ideals and what it wanted to provide for families, I just felt safe. It’s teaching me how to relax a bit when it comes to finances with my children.”

Osper was founded by Alick Varma, a maths teacher turned entrepreneur, who was given responsibility for managing his own budget at a young age by his accountant parents. He is passionate about empowering young people to manage their own money.

As such, Osper is focused on redesigning banking from the ground up for young people through devices and experiences they understand. Osper’s “dual-app” for young people and parents, with real-time monitoring of spending and loading, will create more transparent and open conversation about money. Simple features like “Osper Allowance” with SMS alerts, will kick-start their habit of weekly or monthly budgeting from a young age.

Osper has added further features to the service to give parents using it total peace of mind.

-

Easy safe setup - The ability for parents to get up and running in under two minutes, for free, from mobile or web. Fraud and identify checks in real time removing the need to visit a branch.

-

One app, two logins - A secure banking app which both young people and parents can download and log in to from their own mobile phones to manage the same Osper Card.

-

Instant Loading - The ability for parents to instantly load money from their Debit Card onto their child’s Osper Card account instead of giving cash or in emergencies.

-

Monitoring spend - Instant balance checking and monitoring of transactions, including Osper Alerts - SMS alerts for transactions declined due to insufficient funds.

-

Card Lock - Simple card lock function both young people and parents can use directly from the app if the card is lost or stolen to block all purchases.

-

No overdraft - No overdraft facility so young people can only spend the money they have – it’s not a credit card.

Alka who is using Osper to help her son Anand prepare himself for financial independence at university added:

“Osper works for my child, it works for me. It gives him the independence and the control of the decision making. As a parent it gave me the sense of being able to let go.” (See Alka’s story below)

Alick Varma, Founder of Osper, commented: “While parents currently spend an average of £10,000 a year on their children, young people are only accountable for around 5% of that1 (about £10 a week) – this leads to far too many young adults leaving home without experience of budgeting and unprepared to manage the financial responsibilities ahead of them. There is also a heavy reliance on parents lending their credit card for purchases with one in five UK children using their parents' cards in secret2.”

“We need to reinvent banking for young people and help parents pass on more responsibility at an earlier age. This will ensure young people enter into adulthood with the tools and self-confidence needed to manage their first pay cheque or university loan. Osper gives young people the freedom and control needed to ‘learn by doing’ within the framework of a safe and secure family environment.”

“We need to reinvent banking for young people and help parents pass on more responsibility at an earlier age. This will ensure young people enter into adulthood with the tools and self-confidence needed to manage their first pay cheque or university loan. Osper gives young people the freedom and control needed to ‘learn by doing’ within the framework of a safe and secure family environment.”

Parents and young people can download the app for free via the Apple App Store or Google Play (young people can login on their parent’s mobile device if they don’t have their own). The online sign up process is quick and simple at www.osper.com. Cards are delivered to your door and are free for the first year (£10 per year per card thereafter) with no hidden fees. To find out more or order an Osper Card for free, please visit https://osper.com or watch the clips below.